Contact Us

Address Location

ABIS Centre, Room 16, Providence Estate, Mahe, Seychelles

Spread is the difference between the Buy and Sell price for each asset. This is the essential cost of any CFD trader. The spread that Blue Suisse charges you is based on several factors, such as market depth, Liquidity Provider's availability or your account type. It is Blue Suisse's mission to give you the lowest spread possible. Our spreads are variable and subject to change upon market conditions.

The amount charged when Client enters a CFD transaction for certain products. It is based on the account type and the notional value of the trade. The total commission fee is charged at the opening of the transaction at once.

All positions held open overnight at the end of the daily trading session are subject to credit or debit depending on the prevailing market. If your account is Swap Free (Islamic), this doesn't apply to you.

We apply a 3-day rollover on all open positions: Wednesdays for Currencies, Energies and Metals; Thursdays for Cryptos; and Friday for indices.

You can fund your trading account with several options, including bank transfer and credit card.

To fund your account, please log into your client portal and visit Fund tab.

You can fund your wallet in these denominations: EUR, USD , GBP

You can request a withdrawal at any time. Due to AML laws and practices, withdrawals are based on requests and approvals. You can expect your successful withdrawal request to be completed within 2-5 working days.

To withdraw funds, log into your client portal and go to Funds tab.

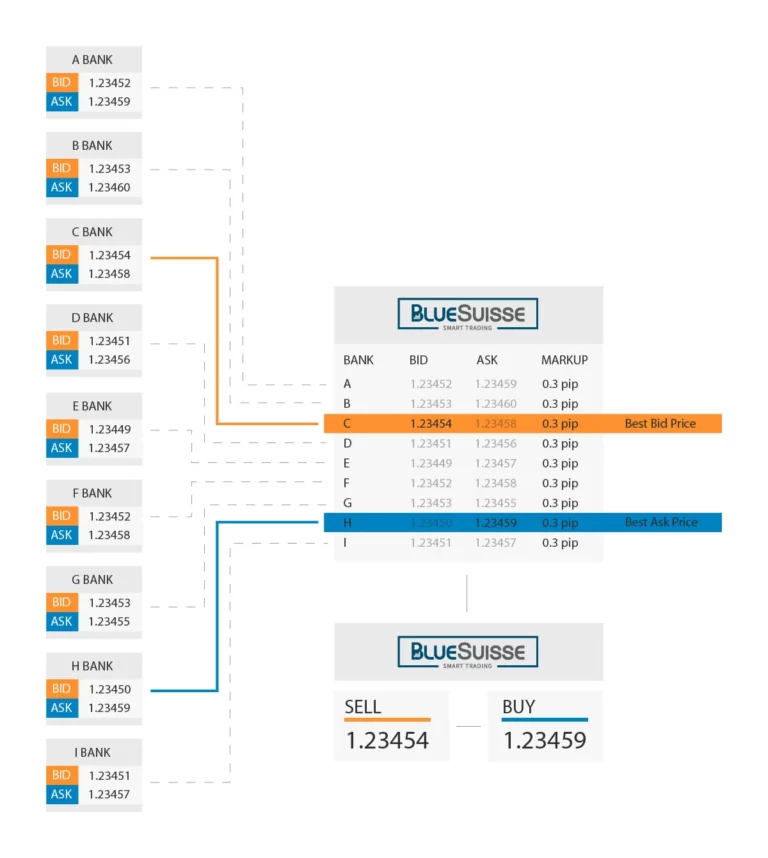

Blue Suisse upholds a fair and transparent trading model to establish a long-lasting and mutual trust-based relationship with clients. Our advanced system allows price aggregation and matches the best offer for your orders.

As we receive your order, our pool of liquidity providers including major banks and brokers compete to offer us the best prices for execution.

Our advanced infrastructure and price aggregator systems allow for instant and continuous quotes from all liquidity providers. Then, our systems analyze quotes in milliseconds and identify the best price available to fill your order.

Transparent and Fixed Markups

Our system builds prices in milliseconds without intervention. Our markup (our income) is automatically added to the price and it depends on your account type as well as the instrument you trade.

Register with us and log in into your Client Area, upload required documents.

Choose a convenient payment method and fund your account.

Download your preferred platform, access it with your login credentials and enjoy trading.